Financial scams have become more sophisticated and easier to perpetrate, ballooning into a billion-dollar industry in Australia, experts have warned.

Last year more than 239,000 scams worth $570m were reported to Scamwatch, but the organisation says the real number is much higher, as only about 13% of scams are reported.

Investment scams remain the number one risk for Australians, but there has been an increase in phoney text messages, such as the “hi mum” scam, in which fraudsters send a text message pretending to be a family member.

Some recent examples have been highly sophisticated, with scammers calling from numbers that appear to be based in Australia and pretending to be from either the victim’s bank or a company such as Amazon, stating their account has been compromised and asking for personal data.

I believed the SMS was from my bank – and fell victim to a $22,000 scamRead more

Dan Halpin, the chief executive of Cybertrace, a company that specialises in cyber fraud investigation, said scams were becoming highly sophisticated.

“We have noticed an obvious change in the level of sophistication and victim manipulation over the past two years,” Halpin said. “As with any crime method, the longer it is used, the more refined it becomes.”

Halpin said fake cryptocurrency or forex broker websites were still the most common scam, but there was an increasing trend in online job/hotel booking assistant scams.

“Like the ‘hi mum’ scams, the online job/hotel booking assistant scams are often conducted via WhatsApp and other similar messaging platforms,” he said.

“We foresee that this scam type will affect many more Australians in the coming months and it is definitely one to be aware of.”

On Saturday a 21-year-old Melbourne man was charged with five counts of obtaining property by deception in connection with the “hi mum” scam. He will appear in court in July.

Quick Guide

Scams in Australia

Show

In 2022 there were 239,247 scams reported to Scamwatch. Of these, 12.1% of victims suffered a financial loss, totalling $569m.

Australians lost the most to investment scams ($377m) then romance scams ($40m) and false billing ($25m).

The largest amount of money, $141m, was lost through scams conducted over the phone, from 63,821 reported scams.

Those conducted over social media were the next most effective, with 13,425 reports and $80m lost.

More scams were delivered via text message than any other means, with 79,835 reports, but they accounted for losses of only $28m.

Source: https://www.scamwatch.gov.au/scam-statistics

Was this helpful?Thank you for your feedback.

Halpin said Australians were a popular target for overseas syndicates because they were more trusting, had larger savings due to superannuation and low cyber fraud literacy.

-

Sign up for Guardian Australia’s free morning and afternoon email newsletters for your daily news roundup

Despite the increasing ingenuity of some scams, they did not necessarily require high-level technological ability, Halpin said.

“Today, although the high-return scams are definitely operated by professionals with significant technical and business capability, the hi mum scams remind us that scams can be low cost, low risk and high reward.”

Aya (not her real name) was targeted when she was looking for a job this month. Within two days she lost $7,000 – her entire savings.

The 35-year-old was looking for a full-time job through recruitment agencies when she was contacted over WhatsApp and offered a trial. Struggling financially, she jumped at the chance to bring home more money.

View image in fullscreenThe website Aya was offered ‘a job’ for is still up and in use

View image in fullscreenThe website Aya was offered ‘a job’ for is still up and in use

Aya was put in touch with a woman who said she worked for the American creative development company Naked, a real company that has no connection to the scam, and who offered her a job optimising data.

The woman directed her to a website where “training” for the job would be conducted.

skip past newsletter promotion

Sign up to Morning Mail

Free daily newsletter

Our Australian morning briefing breaks down the key stories of the day, telling you what’s happening and why it matters

Enter your email address Enter your email address Sign upPrivacy Notice: Newsletters may contain info about charities, online ads, and content funded by outside parties. For more information see our Privacy Policy. We use Google reCaptcha to protect our website and the Google Privacy Policy and Terms of Service apply.

after newsletter promotion

“She signed me in, she credited an account, and it was like she was giving me training, she went through every step,” Aya said.

Aya was told that to land a salary she first had to tip money into an account, via Binance, a cryptocurrency exchange. The more money she put in, the more rewards were generated and the more she would get back.

She was doubtful, but the company put $800 in to start and she was added to a group that appeared to have 30 other people with Australian phone numbers who were all talking about how great the job was.

“It was like gambling, the website, all of it was like a slot machine,” she said. “Your balance went from negative to positive, then when it was back to negative you had to put in another deposit.”

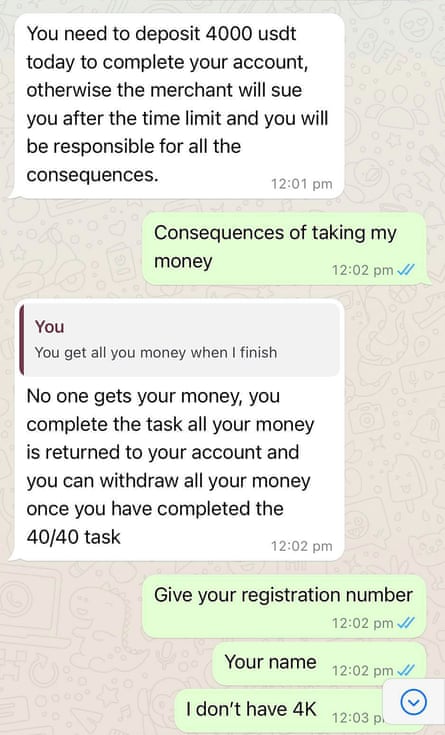

View image in fullscreenConversations between Aya and the scammers turned threatening after she refused to give any more money

View image in fullscreenConversations between Aya and the scammers turned threatening after she refused to give any more money

Aya was threatened by the scammers when she said she had no more money to put in.

She contacted her bank, the Australian Competition and Consumer Commission and the Cyber and Infrastructure Security Centre, but was told there was nothing they could do because she was transferring money through Binance. The website is still operating.

“I’m really ashamed about what’s happened,” Aya said. “I just want other people to be aware. Don’t go through what I went through.”

Australia’s major telcos say they block millions of scam calls and texts each day but scammers quickly learn to adapt and avoid the roadblocks introduced to stop them.

Ashish Nanda of the Centre for Cyber Security Research and Innovation at Deakin University said it was almost impossible to get money back once it was transferred to cryptocurrencies.

“The bank can’t do anything, you’ve already converted your money into crypto,” he said. “You can try and track it, but there’s no reversing it.”

Scammers often knew enough about their victims – their address, the bank they use, their financial history – to know how to play on their emotions, he said.

The best thing anyone could do was avoid being scammed in the first place, he said.

“If people are aware of how scams happen, then they may not invest the funds, or they’ll at least think twice.”