The chancellor, Jeremy Hunt, has pressed the button on a new wave of austerity in an autumn statement that will bring to an end eight years of improved living standards.

Hunt left the three main tax rates unchanged – 20p basic, 40p higher and 45p additional rate – with the first £12,750 of income tax-free and the 40% rate starting at £50,270. However, he did lower the threshold at which Britons start paying the 45p top rate of income tax to £125,140 – a measure that will pull 250,000 people into the top rate.

In the 2021 spring budget, the then chancellor, Rishi Sunak, set up a four-year freeze on personal tax thresholds that began in April. Over time, this drags more low-income households into paying basic-rate tax (which kicks in at £12,570) and those with earnings nearing £50,000 into the higher 40% rate. Now Hunt has gone even further, by prolonging this deep freeze for a further two years, meaning no change until 2028.

Autumn statement 2022: key points at a glanceRead more

However, the state pension and benefits will rise 10.1% from April, in line with September’s inflation rate, and the “national living wage” for over-23s will increase from £9.50 an hour to £10.42.

This budget was short on good news for Britons struggling with higher food, energy and borrowing costs. The chancellor is also making it easier to raise council tax by 5% in a bid to bolster local authorities’ finances, which will add to the squeeze on household budgets next year.

Genevieve Morris, the head of corporate tax at Blick Rothenberg, described it as a budget that “boils the frog”. “The continued freezing of tax thresholds means most people won’t notice it directly as the temperature increases, and so won’t leap out of the water. They’ll simply discover years down the line that they boiled.”

This is how the autumn statement announcement will impact different households.

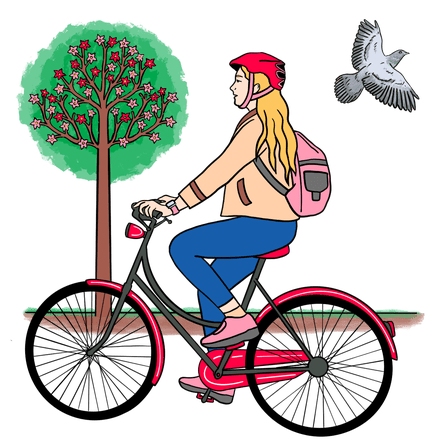

Single person

Earns £38,000

View image in fullscreen

View image in fullscreen

2022/23 She earns the national average wage of £38,000 and pays £5,084 a year in income tax and a national insurance bill of £3,248. Her monthly take-home pay is £2,489 after tax. She also got £400 help from the government with her energy bill.

2023/24 The frozen tax thresholds won’t have any immediate impact on take-home salary and her annual national insurance bill goes down by £196 after this year’s hike in contributions was cancelled halfway through the year. There will be no energy bill subsidy for all this year, and she faces a higher bills because the price cap has increased by £500 to £3,000. Overall, she is £200 worse off.

Single mum, two children

Earns £11,ooo

View image in fullscreen

View image in fullscreen

2022/23 Her low salary means she does not have to pay income tax or national insurance, so takes home £917 a month. She gets £680 in universal credit payments a month and £144 child benefit. She received a £650 cost of living payment.

2023/24 Her take-home pay is unchanged by the autumn statement. She will get £800 universal credit and £160 of child benefit. As she claims means-tested benefits, she will receive the £900 cost of living payment. Overall, she is £1,882 better off.

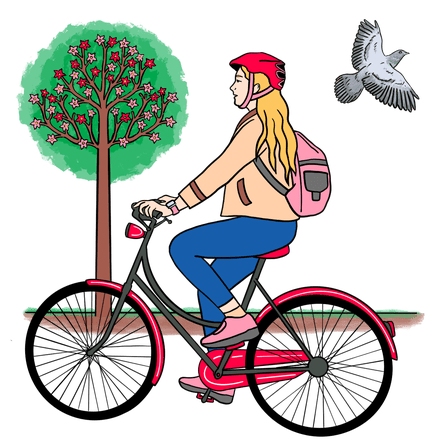

Unmarried couple in their 30s

First income £55,000, second income £35,000

View image in fullscreen

View image in fullscreen

2022/23 Our couple pay a total of £13,913 in income tax and £7,763 in national insurance each year. This results in a combined monthly income of £5,694 after tax.

2023/24 The autumn statement announcement does not change how much income tax this couple has to pay. Again their national insurance bill will fall, meaning they are £453 better off until they get a pay rise to cover galloping inflation, pushing up their tax bill. They also lose the £400 energy bill support.

Unmarried couple, two children, one with a disability

One income of £23,000, with partner a full-time carer

2022/23 The breadwinner’s take home pay is £1,639 a month after tax. They qualify for £756 universal credit, £145 child benefit and £279 carer’s allowance each month. The disability living allowance for their child is £628 a month, and they received an £800 cost of living payment. This resulted in a total income of £42,164.

2023/24 The family’s monthly benefit payments will increase. They will get £954 in universal credit, £160 child benefit, £308 carer’s allowance and £692 disability living allowance. The family will also receive a £1,050 cost of living payment. This adds up to £46,086.

Married couple, three children

One income of £57,000

View image in fullscreen

View image in fullscreen

2022/23 The working parent pays £9,976 a year in income tax and £4,934 in national insurance. This translates into a monthly income of £3,508 plus £60.84 a month in child benefit.

2023/24 This family will see an increase in the amount of child benefit they receive, rising £1.53 to £16.74 a week or £67 a month. Their national insurance bill is reduced by £275 to £4,658. If they earned less than £50,000, they would be able to keep all their child benefit. Overall, they are £355 better off.

Married couple, both disabled

View image in fullscreen

View image in fullscreen

2022/23 The couple receive £880 of universal credit and a combined personal independence payment (Pip) of £243 every month, as well as an £800 cost of living payment.

2023/24 The couple will get £1,050 in cost of living payments due to their disabilities and the fact that they claim means-tested benefits. Their universal credit payment will increase to £969 a month, and their Pip will rise to £268. Overall, they are £1,681 better off.

Married couple

First income £150,000, second income £85,000

View image in fullscreen

View image in fullscreen

2022/23 This high-earning couple pay £73,888 income tax each year, and £12,791 in national insurance contributions, which were higher for the first part of the financial year. Their combined take-home pay each month is £12,360.

2023/24 After the budget, their income tax bill rises by £1,243 to reflect the lowering of the rate at which additional rate tax is paid to £125,000. This increases the couple’s income tax bill to £75,131, but their national insurance contributions are £1054 lower at £11,737, leaving their income virtually unchanged.

Single pensioner on state pension, also gets pension credit

View image in fullscreen

View image in fullscreen

2022/23 His state pension is £141.85 a week or £567 a month and he also gets the pension credit top-up worth £40.75 a week, or £163. He qualified for £950 of cost of living payments.

2023/24 This pensioner will benefit from the 10.1% benefits uplift. He will now get £156 basic state pension a week, or £624 a month, and a £179 pension credit top-up. He will receive cost of living payments worth £1,200. Overall, he is £1,209 better off.

Married pensioners in their 70s

State pension plus £8,000 private pension

View image in fullscreen

View image in fullscreen

2022/23 One half of this couple gets a basic state pension of £142 a week, plus a private pension of £154 a week. The other has a weekly state pension of £85. They pay income tax of £307 on the private pension and received a £300 cost of living payment.

2023/24 They are £1,044 a year better off after the autumn statement, due to the rise in the state pension. They will also receive another £300 cost of living payment.

Married couple

One is a small company director whose company makes £40,000 after expenses. She takes a salary of £9,100, pays corporation tax on the remainder and receives dividend payments of £25,029. Her wife is a teacher earning £30,000.

View image in fullscreen

View image in fullscreen

2022/23 The couple pays £3,484 income tax on the teacher’s salary, £2,254 national insurance, £5,871 corporation tax and £1,957 income tax on dividends. They have take-home pay of £56,433 a year.

2023/24 Changes to the dividend tax rule mean the couple are worse off as they have to pay £2,042 income tax on company dividends. The teacher’s national insurance bill drops to £2,092, so their combined income is virtually unchanged, at £56,511 a year.