Consumer-facing technology brands have done much to reset customer expectations around speed, but also convenience, value and choice.

Consumers can send and receive e-mail across the globe almost instantly. They can stream digital

Real-time payments: The need for speed

content live, or summon a cab or a meal within minutes. What are the implications of this need for speed for the payments industry? And to what extent are real-time payments the rails on which future innovation will run?

Life in the digital age is resetting our notions of speed and time. The average attention span in 2015 was 8.25 seconds, down from 12 seconds in 2000, according to Statistic Brain. This is now less than the nine-second attention span of a goldfish. In a world that seems to be on permanent fast-forward, waiting five-to-six days for a cheque to clear, or three days for a bank transfer to reach the beneficiary’s account, is like being stuck in reverse. It seems like banking from a bygone era.

The payments industry is at the confluence of many trends, some behavioural, some technological and others regulatory. Momentum behind real-time payments is building globally. We examine the drivers, the implications for end-users and those who serve them, and what the future may hold for payments in real-time.

The real deal

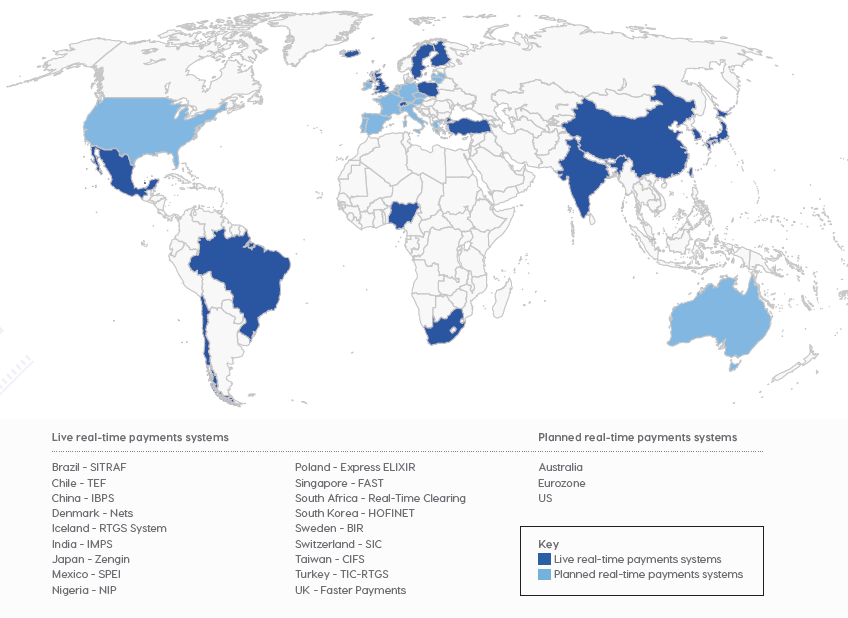

Real-time payments systems are not new. The first domestic real-time payments system was launched in Japan in April 1973, and there are currently 18 real-time systems live worldwide. But what are real-time payments exactly?

Definitions vary and not all systems worldwide currently conform to the one that follows. Generally real-time payments are where funds transferred are available on the beneficiary’s account instantaneously, immediately or in real-time. A real-time payment system must be able to send and receive payments 24x7x365. Once they are processed, payments cannot be recalled. There is a finality to payment, but also a certainty as payments sent to a beneficiary’s account are either confirmedto both the payer and payee or rejected.

“In most countries, you tend to have a couple of payment systems: automated clearing house (ACH) and real-time gross settlement (RTGS),” explains Barry Kislingbury, director, solution consulting, immediate payments, ACI Worldwide.

“ACH tends to be for low-value, high-volume payments, such as paying the gas bill. It takes about three days to settle. With RTGS, the payment is settled on the same day. This system was intended for high-value, low-volume payments, such as buying a house or for corporate or interbank payments.”

“Real-time payments sit in the middle. They are an ACH-type payment over an RTGS-infrastructure, so they are performed in real-time but at the sort of price an ACH would charge for a payment — so much lower than RTGS.”

The drivers for real-time payments

The speed, certainty, coverage and cost of real-time payments is driving increasing interest in the mechanism. Consumers do not necessarily understand bank back-office clearing and settlement processes, and nor should they. When they can browse, buy and download digital goods in real-time, any time of the day or night, they cannot understand why the digital movement of money is not instantaneous. They expect to be able to make and receive payments faster.

Advancements in technology are also making real-time payments possible. There were around 4.7 billion unique mobile subscribers worldwide in 2015 (a 63 percent penetration rate), according to the GSMA, a body that represents the interests of mobile operators worldwide. When the smartphone is the device of choice for accessing the internet — and is the only means a consumer has of getting online in some countries — this cannot but change the way consumers, businesses and governments interact and transact. Mobile phone ownership and access to high-speed broadband are also pre-requisites for mobile-initiated push and pull payments.

Enterprise technology has also advanced significantly since the first real-time payments systems were launched 40 years ago. “The banking community has ambitions to improve and modernise the payments infrastructure,” says George Evers, immediate payments services director, VocaLink. “This allows innovation and defends against FinTech activity that is starting to bite into every element of a bank’s product portfolio.” The infrastructure investments made now will power the products and services of the future.

A combination of factors is driving the change [towards real-time payments] and these differ from country to country. George Evers, immediate payments services director, VocaLink

Policy makers and regulators are clearly interested in making payments more efficient, interoperable and cost-effective, with a view to driving economic growth, innovation and financial and social inclusion. The lower costs of real-time payments versus traditional card-based or RTGS payment is also an attractive feature for regulators, as well as other participants in the payments system.

This time the revolution is for real(-time)

‘Revolutionary’ is a somewhat over-used and de-valued term in the age of PR and hype. However to what extent is the term justified in the context of real-time payments?

“Real-time payment is revolutionary because it’s game-changing,” says Kislingbury. “If you take any bank payment process, what would happen if that could be done in real time?”

Businesses and corporates have huge scope to use real-time payments to improve their cashflow, supply chain management, stock control and reconciliation. This could lead to productivity and efficiency gains but also to direct bottom-line benefits.

For example, a company with a global supply chain could offer to pay suppliers ten percent of the fee in real time when goods were loaded onto a ship. They would then pay the next ten percent when the ship arrived at its first port and so on until the ship arrived at the final destination whereupon the payer would settle the outstanding amount in full. In this way, real-time payments could enable businesses to offer improved invoicing terms to suppliers that could help increase working capital.

For retailers, real-time payments could enable just-in-time stock management with the associated operational and cost efficiencies. This obviates the need to carry an inventory, and could lead to fulfilment efficiencies. When a customer ordered an item, the retailer would in turn place an order with their supplier and pay in real time. The supplier would then dispatch the item either to the retailer or to the customer directly. The retailer would not have to pre-pay or store stock. They would also increase fulfilment options to the customer, and cut the costs of wastage due to unsold goods. Just-in-time stock management also has implications for the retail store of the future in terms of the purpose, design and number of stores.

For consumers, a number of possible propositions draw on the speed of real-time settlement. For example, emergency funding propositions where the transferred funds are available immediately to the beneficiary (e.g. social benefit claimant or child). With the rise of of part-time work, mini jobs and zero-hours contracts, employers could also pay workers quickly and easily via real-time payments. Gambling operators could accept wagers and pay winnings in real time, avoiding customer disgruntlement at the traditional two day wait for payment card credits to settle.

For banks, real-time payments will be no less significant. They will be the catalyst — and perhaps the imperative — for them to devise new business cases and revenue streams. “The banks actually have to change their business models. It’s no longer about making money from the payment. It’s about making the payment invisible and offering value-added services around it,” comments Kislingbury.

There is an obvious parallel with merchant acquiring, which is becoming an increasingly commoditised business at the transaction processing level. Acquirers are already revising their business models to secure their futures. They are exploring how they add more value to customers, and devising innovative, chargeable services for which merchants would be willing to pay. “It’s exactly the same argument across correspondent and retail banking. Moving money is what banks do, but there’s no real value in that these days because everyone can do it. It will be about what value you bring to your customer,” says Kislingbury.

The revised EU Directive on payment services (PSD2) is intensifying the pressure on European banks. Improving access to payment accounts and increasing transparency around payments and charges are two of the main themes running throughout the Directive. This is not a peculiarly European phenomenon. Banking executives worldwide are currently grappling with how they can create and maintain value. And how they can capitalise on the move to a more open banking environment.

Faster, richer data

Value is increasingly bound up with data. Thanks to the ISO 20022 standard, real-time payments come with speed but also with richer data. Kislingbury explains the background and differences between ISO 8583 and ISO 20022.

“ISO 8583 is a small, lightweight message, designed to move the value of a payment quickly across systems built on the technology of 40 years ago. It’s quite a complicated, heavily modified standard because there is such a small amount of data. All the schemes use the standard differently to achieve what they need to. Although it’s a standard, it’s a type of non-standard as well.”

ISO 20022 is not actually a messaging standard. It is a standard to develop standards. Or a standard that helps define a business process. ISO 20022 comes with a large data dictionary, defining a wide range of business processes and the data required to support them. “It’s a much bigger message, but technology has moved on and can cope with that. You can describe the entire transaction: remittance information, purchase order numbers, invoice numbers. There’s a whole raft of things you can do, if you’ve got that data,” explains Kislingbury.

The banks actually have to change their business models. It’s no longer about making money from the payment. It’s about making the payment invisible and offering value-added services around it.

Barry Kislingbury, director, solution consulting, immediate payments, ACI Worldwide

There is huge potential for banks in terms of innovative, chargeable services they can overlay on a real-time payments infrastructure based on ISO 20022. Unsurprisingly, many countries with live real-time payments systems are actively looking to upgrade to ISO 20022. This includes China, South Africa and Switzerland. Meanwhile, countries such as Australia, the Eurozone countries and the US are building real-time payments systems on ISO 20022 from the outset.

However to enable cross-border payments regionally, if not globally, requires interoperability. This came a step closer in August 2015 with the publication of the first draft of ISO 20022 messages. The draft was the result of work by the ISO real-time payments group (RTPG), made up of over 50 international experts.

“There are a lot of countries designing and building real-time payments on ISO 20022. Historically those countries, which have already built systems on the standard have used it slightly differently. We wanted to put together a best practice guide to ensure interoperability,” explains Kislingbury, who participated in the ISO RTPG.

Keeping it real

Besides interoperability to facilitate cross-border payments, what needs to be in place at a domestic level to implement a real-time payments system? According to George Evers at VocaLink, alignment across a broad community within the country is critical.

“Real-time payments delivers benefits to banks, consumers, government and businesses of all shapes and sizes,” he says. “To ensure ubiquitous adoption, it is best to engage widely to agree a common approach to solving problems and ensure the needs of these different communities are met through the solution.”

As with the implementation of many payment technologies — everything from EMV chip and PIN, to contactless, to mobile payments — critical mass on the consumer and merchant side together is key. Achieving this is partly a matter of ensuring that the system supports end-user requirements from a technical and operational point-of-view. However it is also a question of coverage (or reach) and access.

Faster Payments Scheme Limited (FPSL), the company behind various UK payments systems, is looking to open up the infrastructure to a broader base of banks and PSPs to provide easier and more cost-effective access. Consequently it is having to address challenges germane to real-time payment schemes generally, namely balancing access with security and the integrity of the system, particularly around 24×7 operation, payments delivered in seconds, high availability and certainty of funds.

FPSL is introducing aggregator models plus a new settlement model between participants to encourage direct access. “This creates a much easier environment for small banks, who are currently restricted to being secondary suppliers through a major bank, as they will have direct access,” explains Bob Mackman, director, Mackman Associates, a vendor participating in the Access to Payment Systems programme run by FPSL.

“At the moment, the smaller banks are dependent on the facilities of the major bank. This way, they’ll get much closer to 24×7 at a much more realistic price, so they’ll be able to offer these sorts of services,” says Mackman.

I believe that real-time payments will be the new normal for payment. And that real-time payment infrastructures will allow convergence of batch multi-day or same-day systems through to card clearing infrastructures.

George Evers, immediate payments services director, VocaLink

Real-time payments is not the panacea to cure all payment ills. Real-time payments are fast, but how much speed does the end-user need, and when? Real-time payments based on ISO 20022 can pass richer data, but how much more data does the end-user need, and when?

The future is happening in real-time

Unless there is a compelling reason to change, payers are not usually looking for a new way to pay. Thus, devising compelling use cases and propositions at the right price will be critical to the take-up of real-time payments. As will getting more participants to use the system, thereby generating more value for everyone who participates.

However, the momentum and excitement around real-time payment is justified. Real-time payment has the potential to be game-changing for all participants in the payments system. So far, the majority of real-time payments systems are based on push payments. But pull-based real-time payments in the retail and government sectors will have an even greater impact on incumbents’ business models and revenue streams. The risk of disintermediation, particularly for card schemes, of future innovation based on real-time rails is very real.

How long will it take for real-time payments to become a reality in more and more countries, and internationally? When will then be now? Soon. While there is no such thing as a simple payments system, the future is happening soon. However it may yet be happening sooner than soon. It may be happening in real-time.